What is cryptocurrency and how does it work

A cryptocurrency wallet consists of public keys and private keys. Public keys are similar to bank account numbers — they show your cryptocurrency balance without compromising the security of your account. https://bettingtanzanias.com/winprincess-app/ Meanwhile, private keys allow the wallet owner to access their cryptocurrency and sign off on transactions.

BitPay is straight up awesome. I convert my crypto profits to BCH because it has the cheapest transfer fees then transfer to the BitPay BCH wallet and then over to the physical MasterCard to fix the price to USD. Then I buy pizza. Thank you BitPay and MasterCard for being front runners in the new economy.

3. Add cryptocurrency to your wallet. Your account on the exchange works as a wallet, so once you’re in, you can use your new wallet address to transfer crypto from another wallet. You can also purchase coins directly on the exchange by linking your bank account. With most exchanges, you can pay through ACH or wire transfer and use debit or credit cards. Fees sometimes vary by payment method.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

Select Your Operating System, choosing the appropriate version for your operating system (Windows, macOS, or Linux). Download the installer file and run it, following the on-screen instructions until complete.

Cryptocurrency pi value

While Pi tokens are not yet operational or even available on major exchanges, millions of “Pioneers” around the world continue to accumulate Pi coins every day. This is where the concept of Pi IOUs (or “I Owe You”) has risen, allowing for the speculative trading of Pi coins on select exchanges.

Just like with any other asset, the price action of Pi Network is driven by supply and demand. These dynamics can be influenced by fundamental events such as block reward halvings, hard forks or new protocol updates. Regulations, adoption by companies and governments, cryptocurrency exchange hacks, and other real-world events can also affect the price of PI. The market capitalization of Pi Network can change significantly in a short period of time.

Pi is currently in the Enclosed Network period of Mainnet and is not approved by Pi Network for listing on any exchange or for trading, and Pi Network is not involved with any purported postings or listings.

While Pi tokens are not yet operational or even available on major exchanges, millions of “Pioneers” around the world continue to accumulate Pi coins every day. This is where the concept of Pi IOUs (or “I Owe You”) has risen, allowing for the speculative trading of Pi coins on select exchanges.

Just like with any other asset, the price action of Pi Network is driven by supply and demand. These dynamics can be influenced by fundamental events such as block reward halvings, hard forks or new protocol updates. Regulations, adoption by companies and governments, cryptocurrency exchange hacks, and other real-world events can also affect the price of PI. The market capitalization of Pi Network can change significantly in a short period of time.

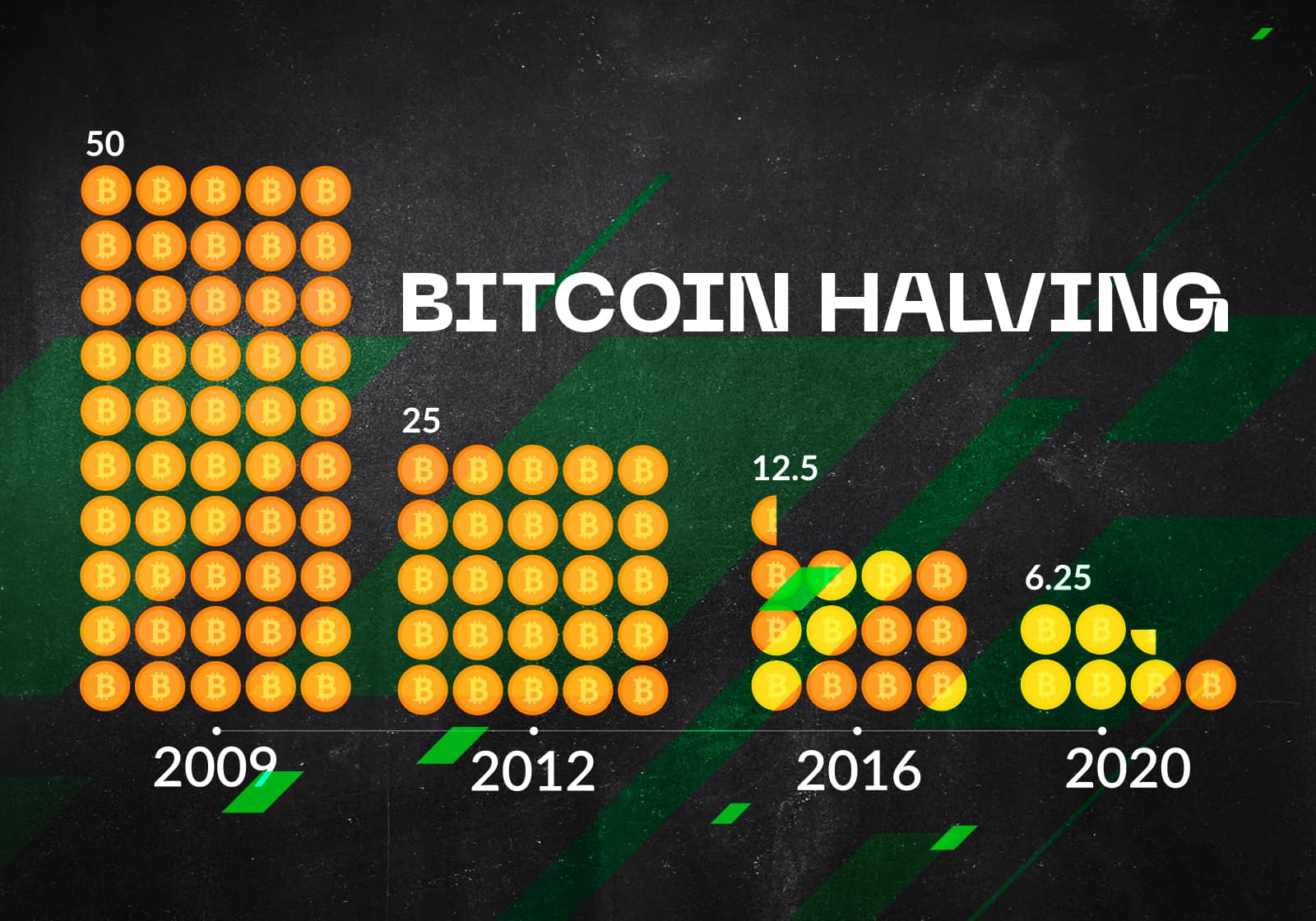

Cryptocurrency halving

After every 210,000 blocks that these miners add to the chain, the number of Bitcoins they receive as a reward is halved. This happens approximately every four years. This event is a built-in feature of Bitcoin, effectively designed to control inflation. At this point in time, there are about 19.5 million Bitcoins that have already been mined, while the maximum supply is fixed at 21 million Bitcoins. Considering all upcoming halvings every 210,000 blocks (~ 4 years), the last Bitcoins will be mined around the year 2140. Consequently, in the next 116 years only 1.5 million Bitcoins will be created, which underlines that the remaining inflation is very marginal from a technical standpoint.

To conclude, the upcoming Bitcoin halving could fuel the market dynamic of the whole crypto ecosystem once again, making it an important milestone and more than a mere technical event. Media coverage will probably increase over the next few months and thus it is important for corporates and investors to know about the current developments and think about potential implications for them. In addition, the surge of those Bitcoin Spot ETFs make it easier than ever to participate in this market.

After a period of a lot of media attention around newly launched Bitcoin Spot ETFs in the US, there is another, more technical but fundamental milestone around the corner in 2024 – the 4th Bitcoin halving.

After every 210,000 blocks that these miners add to the chain, the number of Bitcoins they receive as a reward is halved. This happens approximately every four years. This event is a built-in feature of Bitcoin, effectively designed to control inflation. At this point in time, there are about 19.5 million Bitcoins that have already been mined, while the maximum supply is fixed at 21 million Bitcoins. Considering all upcoming halvings every 210,000 blocks (~ 4 years), the last Bitcoins will be mined around the year 2140. Consequently, in the next 116 years only 1.5 million Bitcoins will be created, which underlines that the remaining inflation is very marginal from a technical standpoint.

To conclude, the upcoming Bitcoin halving could fuel the market dynamic of the whole crypto ecosystem once again, making it an important milestone and more than a mere technical event. Media coverage will probably increase over the next few months and thus it is important for corporates and investors to know about the current developments and think about potential implications for them. In addition, the surge of those Bitcoin Spot ETFs make it easier than ever to participate in this market.

After a period of a lot of media attention around newly launched Bitcoin Spot ETFs in the US, there is another, more technical but fundamental milestone around the corner in 2024 – the 4th Bitcoin halving.